How Much Is Tax On Furniture In Arkansas . the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. City and county sales & use tax rates. The state sales tax rate in arkansas is 6.500%. sales & use tax rates. With local taxes, the total. local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. State sales & use tax rates. arkansas (ar) sales tax rates by city. arkansas sales tax calculator. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. 624 rows arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to.

from printableformsfree.com

the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. 624 rows arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. sales & use tax rates. arkansas sales tax calculator. City and county sales & use tax rates. arkansas (ar) sales tax rates by city. State sales & use tax rates. local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and.

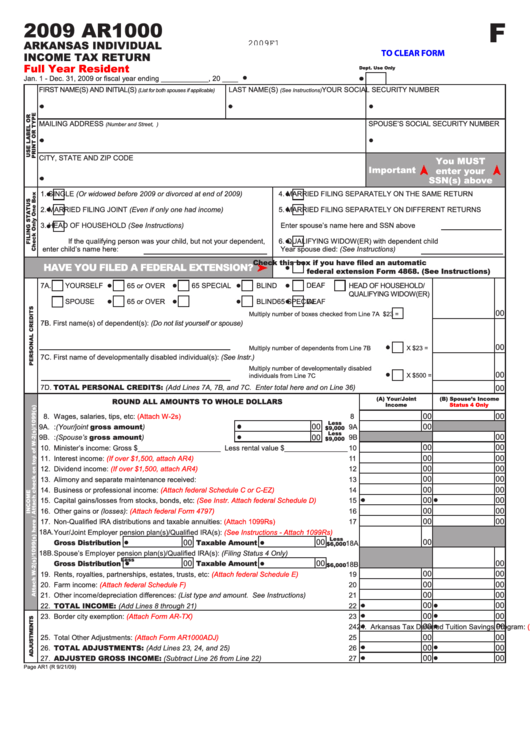

Printable Arkansas Tax Forms Printable Forms Free Online

How Much Is Tax On Furniture In Arkansas sales & use tax rates. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. City and county sales & use tax rates. State sales & use tax rates. arkansas (ar) sales tax rates by city. With local taxes, the total. 624 rows arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. arkansas sales tax calculator. sales & use tax rates. The state sales tax rate in arkansas is 6.500%. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /.

From www.signnow.com

Tax in Arkansas Complete with ease airSlate SignNow How Much Is Tax On Furniture In Arkansas local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. 624 rows arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. arkansas (ar) sales tax rates by city. With local taxes, the total. State sales. How Much Is Tax On Furniture In Arkansas.

From www.dochub.com

Arkansas st391 form Fill out & sign online DocHub How Much Is Tax On Furniture In Arkansas the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. sales & use tax rates. City and county sales & use tax rates. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. You can. How Much Is Tax On Furniture In Arkansas.

From uca.edu

Recent Tax Cuts in Arkansas Haven’t Cut Into the State Budget How Much Is Tax On Furniture In Arkansas arkansas sales tax calculator. With local taxes, the total. arkansas (ar) sales tax rates by city. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. City and county sales & use tax rates. local tax rates in arkansas range from 0%. How Much Is Tax On Furniture In Arkansas.

From www.templateroller.com

2021 Arkansas Annual Bank Franchise Tax Report Fill Out, Sign Online How Much Is Tax On Furniture In Arkansas local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect. How Much Is Tax On Furniture In Arkansas.

From zamp.com

Ultimate Arkansas Sales Tax Guide Zamp How Much Is Tax On Furniture In Arkansas local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. State sales & use tax rates. arkansas (ar) sales tax rates by city. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. City and county sales & use. How Much Is Tax On Furniture In Arkansas.

From lampmanfurniture.com

taxinsale Lampmans Furniture How Much Is Tax On Furniture In Arkansas The state sales tax rate in arkansas is 6.500%. With local taxes, the total. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. arkansas (ar) sales tax rates by city. sales & use tax rates. State sales & use tax rates. . How Much Is Tax On Furniture In Arkansas.

From gis.arkansas.gov

Arkansas Sales and Use Tax Rates April 2018 Arkansas GIS Office How Much Is Tax On Furniture In Arkansas City and county sales & use tax rates. The state sales tax rate in arkansas is 6.500%. arkansas sales tax calculator. local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas. How Much Is Tax On Furniture In Arkansas.

From www.formsbirds.com

Individual Tax Return Arkansas Free Download How Much Is Tax On Furniture In Arkansas sales & use tax rates. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. arkansas sales tax calculator. local tax rates in. How Much Is Tax On Furniture In Arkansas.

From taxfoundation.org

Arkansas Lawmakers Enact Middle Class Tax Cut How Much Is Tax On Furniture In Arkansas 624 rows arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. sales & use tax rates. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. State sales & use tax. How Much Is Tax On Furniture In Arkansas.

From www.boostexcel.com

Multiplepage Excel Invoice Templates How Much Is Tax On Furniture In Arkansas local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. The state sales tax rate in arkansas is 6.500%. City and county sales & use tax rates. arkansas sales. How Much Is Tax On Furniture In Arkansas.

From printableformsfree.com

Arkansas State Tax Withholding Form 2023 Printable Forms Free Online How Much Is Tax On Furniture In Arkansas sales & use tax rates. local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. arkansas sales tax calculator. State sales & use tax rates. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable. How Much Is Tax On Furniture In Arkansas.

From www.templateroller.com

Form FT11 Download Fillable PDF or Fill Online Corporate Franchise Tax How Much Is Tax On Furniture In Arkansas arkansas sales tax calculator. arkansas (ar) sales tax rates by city. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. State sales & use tax rates. City and county sales & use tax rates. local tax rates in arkansas range from 0% to 5%, making the sales. How Much Is Tax On Furniture In Arkansas.

From printableformsfree.com

Printable Arkansas Tax Forms Printable Forms Free Online How Much Is Tax On Furniture In Arkansas the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. arkansas sales tax calculator. the state sales tax rate in arkansas is 6.5%, but you can customize this table as. How Much Is Tax On Furniture In Arkansas.

From www.uslegalforms.com

AR International Fuel Tax Agreement Quarterly Tax Return Fill out Tax How Much Is Tax On Furniture In Arkansas the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. arkansas sales tax calculator. With local taxes, the total. City and county sales & use. How Much Is Tax On Furniture In Arkansas.

From howtostartanllc.com

Arkansas Sales Tax Small Business Guide TRUiC How Much Is Tax On Furniture In Arkansas The state sales tax rate in arkansas is 6.500%. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed to reflect your applicable local sales tax. City and county sales & use tax rates. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales. How Much Is Tax On Furniture In Arkansas.

From startup101.com

How To Get An Arkansas Sales Tax Exemption Certificate StartUp 101 How Much Is Tax On Furniture In Arkansas With local taxes, the total. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. State sales & use tax rates. 624 rows arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. arkansas (ar) sales tax rates. How Much Is Tax On Furniture In Arkansas.

From justonelap.com

Tax rates for the 2024 year of assessment Just One Lap How Much Is Tax On Furniture In Arkansas arkansas (ar) sales tax rates by city. City and county sales & use tax rates. local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. arkansas sales tax calculator. the state sales tax rate in arkansas is 6.5%, but you can customize this table as needed. How Much Is Tax On Furniture In Arkansas.

From www.uaex.uada.edu

Arkansas Local Government Resources County government in Arkansas How Much Is Tax On Furniture In Arkansas local tax rates in arkansas range from 0% to 5%, making the sales tax range in arkansas 6.5% to 11.5%. City and county sales & use tax rates. You can use our arkansas sales tax calculator to look up sales tax rates in arkansas by address /. With local taxes, the total. The state sales tax rate in arkansas. How Much Is Tax On Furniture In Arkansas.